What is interest? What is compounding interest? Do I need to understand what different types of interest are?

Compounding Interest can be crippling without you even knowing.

When we purchase something, through hire purchase, interest free terms, even a mortgage, you need to understand the concept of compounding interest.

If we purchase, for example, something worth $10,000. I like round figures in my examples so you will see a lot of these going forward, they allow my brain to keep up with the calculations 😂😂

The purchase is $10,000 and the interest rate is 10% (round figures of course, unlikely to be that low or that easy to calculate, the highest I have seen is 49%)

We determine from that, every year we will be charged 10% of $10,000. If you are not a maths person, I was always taught that if you replace the "of" with "multiply" you get the answer.

10% x $10,000 = $1,000

We often assume that means that we will pay $1,000 interest per year. If we even think about it at all.

That is not the case, what happens is this, let's assume for this example, this is a five year loan, the interest is calculated as follows:

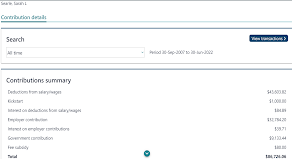

Year 1 10% of $10,000 is $1,000

Year 2 10% of $11,000 is $1,100

Year 3 10% of $12,100 is $1,210

Year 4 10% of $13,310 is $1,331

Year 5 10% of $14,742 is $1,474

Total interest over the term is $6,114

All we tend to look at is the repayments over the term and not the compounding interest.

This illustration above would mean total to pay on the loan (excluding fees) would be $16,114 this would also assume there are no missed payments as they incur penalty interest. It also assumes there is no additional top ups to the loan, which will also change the compounding interest equation.

The fact this is confusing is part of the finance company's business plan.

We all sign up to these plans in moments of desperation when we really need something. To get $10,000 instantly or purchase a $10,000 product instantly, we only look at the repayment amount, which in this case would be something like $268 per month. We just accept it without realising we are "donating" an extra $6,114 to the finance company.

We need to stop this drain on finances. Or at the very least we need to be aware that it is happening.

I appreciate this is a lot of mathematical information and not everyone will get it on the first read through, I implore you to read this until you understand it and move forward on your path to financial independence by understanding this.

I would like you to do the above calculation, with a calculator, with the higher rate as quoted in an advert earlier in this blog with 49% as the compounding interest rate and see how much interest you would end up paying over the five year term, you will be absolutely shocked. Let me know your results in the comments.

Please follow my blog and feel free to share, and comment, I am always happy to get feedback. I appreciate the last two blogs have been quite focussed on numbers and sometimes these are tricky concepts to grasp first time.

Have a spectacular day out there and remember not to sweat the small stuff :)

Comments

Post a Comment