Am I losing money on my Kiwisaver? Is it a good investment? What is really happening? How can I find out what my real return is when comparing it to other investments?

Is Kiwisaver "worth it"? One of the most common questions I get asked.

The simple answer is absolutely!!

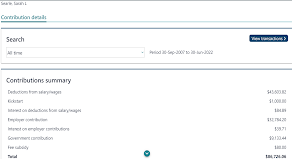

My Kiwisaver figures are above, the one on the left is the amount I have contributed, the top line is what I have personally put into it. The numbers on the right are what my Kiwisaver balance is today.

I have been in Kiwisaver since day one so a long time now, but the deductions from my salary over the years has been $42,603, my Kiwisaver net balance is $114,368.

Basically, the return is ridiculously high, I challenge anyone to get a this type of return on investment anywhere.

When people say, "I have lost $5,000 on my Kiwisaver, it is ripping me off" I challenge them to look at these two screenshots for themselves.

The one on the left is from the Inland Revenue Department and anyone can get it in about five minutes by logging in, or longer if you have to call them, unfortunately the wait time can be horrendous. I feel for the people that work there actually.

The one on the right is from my Kiwisaver Provider. You can ask for a balance from your provider anytime.

When it appears you are losing money, you are not, what is happening is the amount given to you is fluctuating.

It is also important to remember that the net worth of your Kiwisaver at your provider is not really dollars.

It is a calculation of units, as you can see from my one above, I have over 50,000 units that are worth around $2.00 each, the calculation of those is the net worth amount. Every day the value of the units can change. But I will always have the same amount of units and as I contribute more I will always purchase more units.

Kiwisaver is also a great investment if anything was to happen to you. Provided you have a will, it works in a similar way to life insurance. It will mature on your death.

The wonderful thing about Kiwisaver is though, that if you don't die, you still get it.

When you compare it to life insurance there are a number of things to consider.

- Life insurance stops if your payments stop

- Life insurance has an expiry date, so if you die after a certain age it will not pay out

- Life insurance goes up as you get older

- You have to die to win

- Kiwisaver doesn't stop if your payments stop, it remains invested and may even keep increasing in value

- Kiwisaver matures at 65 but you don't have to stop contributing or withdraw it then but you can if you wish

- Kiwisaver doesn't increase premiums as you get older

- You don't have to die to win

Spot on. If you're young it's a great way to save a deposit in the short term:

ReplyDelete~$20 / week turns into ~$50 when you take into account the compulsory employer contribution and the member tax credit, all of which you can withdraw for a first home purchase.

We would have had to save for another 2 years for our first home if we didn't have KiwiSaver, and house prices increased by 50% in that time.

Ngā mihi Sarah, excellent advice.

I am so pleased you have achieved it now. Well done! Make sure you continue to contribute so there is a little nest egg if something was to happen to either of you as well.

ReplyDeleteHi Granny I love your new story's you make love from Zoe

ReplyDeletethanks so much my little sweetheart

ReplyDelete