Are loyalty programmes worth it? Should I have a reward earning credit card? Which rewards are the best? Are they worth it?

Loyalty programmes, are they worth it? Specifically, are credit card loyalty programmes worth it. Are mortgage loyalty programmes worth it?

When looking at loyalty programmes it is important to consider a number of options.

- Is it costing you to be part of the programme?

- Are they are perk from you purchasing something you would normally purchase, or do you have to purchase something you wouldn't normally in order to get the reward? eg. lock into two years of power with us to get a free TV.

- Are they encouraging you to purchase goods you would not normally purchase. eg. get 1000 airpoints if you book your trip to Los Angeles today.

There are some that are truly wonderful perks, supermarket rewards cards (do not be encouraged to spend more than you normally would, just take the rewards you get for your normal spend)

We have rewards cards at the chemist, once again that is great as most of us need to go there at some point, but do not spend more money just to get the rewards.

Make sure you understand the rewards system, any expiry date or special ways you can maximise your reward. eg. the fuel card that offers you up to 6 cents off per litre for every $40 you spend, with a maximum of 50 litres, you are better off to accumulate and then spend all your points on a 50 litre fillup.

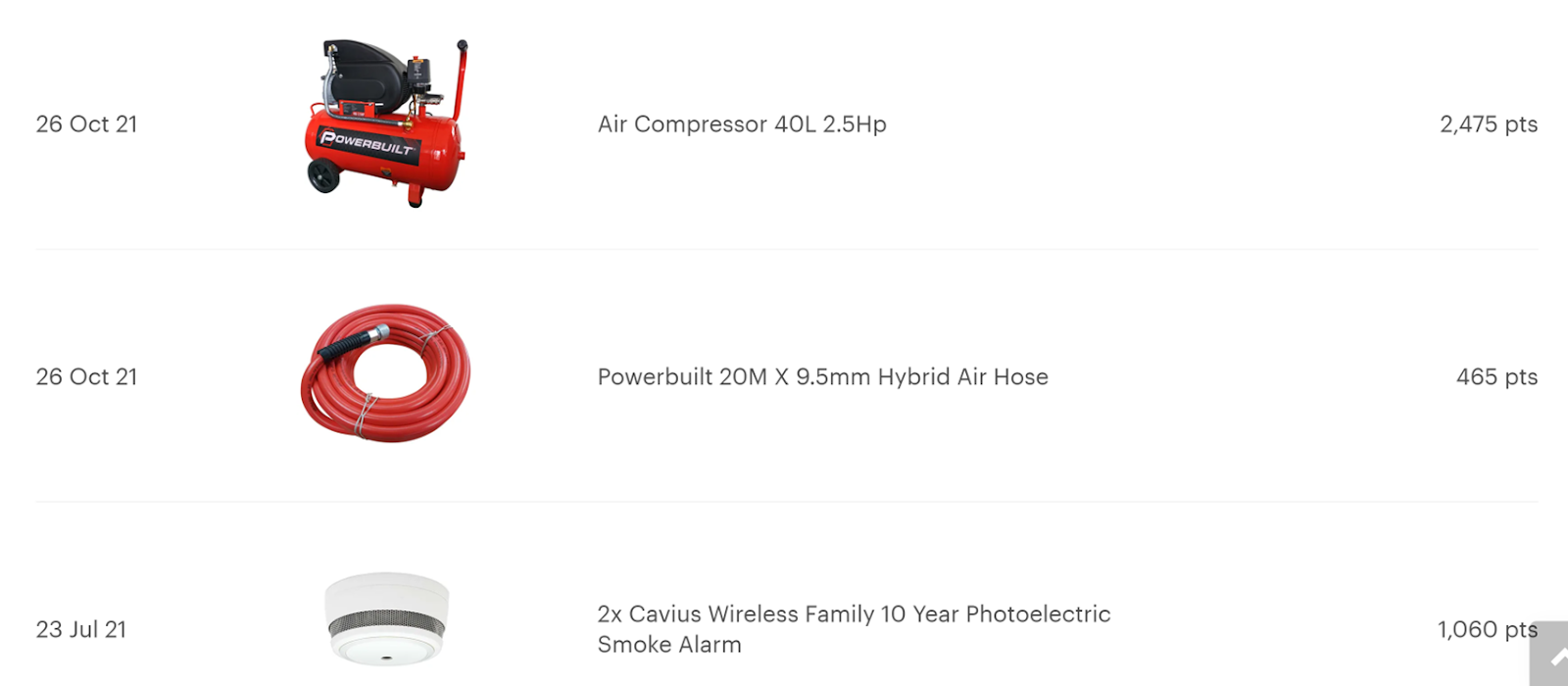

The ones that can make a big difference are credit card rewards systems. Above there are a few rewards I have purchased through credit card rewards.

It is really important to understand a few things about these systems.

- If you have not paid the full amount when it is due, and are paying interest on the card, it is not worth getting a rewards card. Here you are better off to have a low interest card and look at my other credit card blog about getting rid of credit card debt https://granniesarahssolutions.blogspot.com/2023/03/is-there-truly-way-to-get-out-of-credit.html

- The interest rate on a rewards card is almost always substantially higher the higher the rate of reward.

- If you know, WITHOUT EXCEPTION, you can pay the entire amount due on the due date (not to zero and not the minimum payment, but the amount due), THEN AND ONLY THEN, is a high interest credit card good for you.

- If you are satisfied you can do the above then by all means get a high interest, high rewards credit card because, if you do what I said above you will never pay interest. I have had a high interest credit card for over 20 years and not paid a cent of interest and claimed heaps of rewards.

- Get the best card you can that your bank offers so there is no delay when it comes to paying your credit card bill each time.

The rewards pictured above are my favourite ones that I have purchased with my Flybuys card which is the rewards system attached to my visa card.

Yes, that is a full sized air compressor!!! Not sure if you have read my blog about my little green car, but it is important to pump her tyres up and I am not always in town close to a garage or tyre shop. So the compressor has been truly a godsend for me and my little green car. https://granniesarahssolutions.blogspot.com/2023/03/little-green-car-appreciation-whats.html

People say credit cards are expensive, well not in my house they are not! We pay the annual fee yes, but apart from that we pay nothing. We use the credit card for all our bills and for all our expenses, we get a lot of rewards from it. We pay it off each time we get a bill. We pay - to the last cent - what is owed, nothing more and nothing less, on the exact day it is due, so we pay no interest. We get maximum rewards from using it daily.

A small note though, if you are looking at rewards of any sort against your mortgage, they are not worth the ongoing greater interest rate. The credit card is worth the higher interest rate because you are paying in full so interest doesn't apply at all. With a mortgage you are not paying the amount due each cycle you are just paying a small amount off a large debt, so the same doesn't apply.

Hope this makes sense, as far as, "Which rewards system is the best" you need to check that out when comparing these for yourself. Look at two things:

- how many reward do I get for dollars spent?

- how many dollars are the rewards worth?

Good luck out there in the finance world, it is certainly a tricky space to be in, I hope these blogs are helping you, feel free to comment, share, like, or follow as you see fit.

Have a fabulous day out there and remember how strong you are and it is worth taking the time to understand these blogs in order to get ahead. Enjoy!

Great Blog Sarah on credit card's, I enjoyed reading this as one day I would like to look into getting a rewards credit card. Have you got any suggestions on how to put aside money to pay it off in full on the due date? Is it best to have an account you put the money aside in on every purchase? Im just trying to find a good idea that will suit a budget. Thanks a lot - Shawn

ReplyDeleteHi Shawn, you inspired me to write today's blog about credit cards, thanks so much for your question. Have a read of it and let me know if that answers it fully, I am more than happy to clarify. This is the lesson that takes the longest for people to understand in my classes. I hope it helps you, keep the comments and questions coming and feel free to share this blog with everyone and anyone, let's help people get ahead as quickly as possible. We haven't even started on the good stuff yet.

Delete