Is it worth borrowing to invest? Should you invest when you still have debt? Are you making emotional financial decisions?

Have you been told to borrow to invest? Do you have any idea of what that looks like? I want you to have a good zoom in and look at the above two graphs, this is an actual situation someone was in.

This person, let's call him Bob, has a $25,000 investment, fixed term cash account. Great! We are all envious of him.

Bob also has a $25,000 credit card that is maxed out, so -$25,000, he is paying $500 per month on that card.

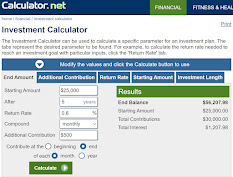

I went online and found the above calculators, the credit card on is at www.sorted.org.nz and the other is at www.calculator.net both of these are reliable and you can pretty much punch in any numbers you want to check out your own debt and investment.

This is a really important exercise to do at any time to see how you are tracking on your goals.

The comparison for these two appears like this:

- Investment of $25,000, in this incident I was looking at paying $500/month, into this account, (same as credit card monthly payment) to see how much could be gained. Over five years, the amount of interest gained would be $1207.99

- Credit Card of -$25,000, in this situation, once again I looked at paying $500/month, into this account to see what it would cost Bob, the amount of interest charged over five years, would be $19,444

So when people suggest paying the credit card off with the money saved or invested, they often say, no way, as they want a nest egg.

But they will continue to drip feed the credit card, remember the credit card, compounding interest will always be greater than any interest offered on any fixed deposit account.

In this case the difference over five years is astronomical the gain being $19,444 less $1207, so a gain (or negative loss) of $18,237.

The best investment is to manage and pay off your debts. Don't increase your debt at great expense in order to have a tiny payment of interest (that is taxed).

I hope this helps you, there is a lot of "interesting" advice out there. Be careful. Feel free to share, comment, like, or follow this blog. I am an independent Financial Adviser and an independent Financial Advice Provider fully registered, so I have no vested interest in which way you go on your journey.

Great stuff Sarah! .. A nice simple, but powerful (and life changing) financial exercise for anyone to follow and implement .. Well done!

ReplyDelete