Do you know anyone who enjoys taxes? Do we all pay too much tax? How can you minimise your tax commitment? Doesn't the accountant do it all?

Do you worry about taxes? Considering Benjamin Franklin came up with this beautiful quote in 1789, you are not alone if you do. People have been "freaking out" about tax for the longest possible time. There are a few things that I can broadly advise you in this space that may just help.

I have had the most spectacular week helping people understand taxes, there are a lot of dos and don'ts but once you understand you can make tax work for you.

Here are a few examples:

- GST, most of us are happy not to register for GST until we earn a lot of money, at that stage we have to. However, when you are building your business, chances are you are spending far more than you are earning, therefore you are running at a loss. A lot of the time during this stage, you are also working elsewhere and having PAYE deducted from your wages, as your business is not earning enough to keep you going YET!

- Declaring income from a "side hustle", if accounted for properly will also probably run at a loss and include depreciation etc. This may be as small as a lawn mowing round or a regular baby-sitting service.

Let's imagine a scenario of the above:

Joe and Susan are a couple, they both work for wages and earn $100,000 gross each. They have a mortgage on their home of $500,000. To make a little extra money, Susan cleans for an elderly neighbour and Joe makes furniture in his garage on the weekend. He sells this in a monthly garage sale and makes a little bit of cash.

As far as IRD is concerned this is what is happening

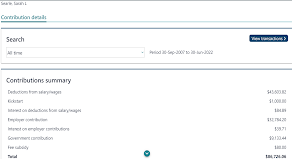

Joe wages $100,000 less $23,920 PAYE

Susan wages $100,000 less $23,920 PAYE

The tax above is calculated automatically and nothing else is mentioned as they make around $1000 per month more between them cash, so $12,000 per year.

If they add up all their expenses: the obvious ones like a share of power, rates, internet, phone, perhaps a 20% share if we consider the amount of their home they are using. Add that to a 20% share of their interest paid on their mortgage over the year. Add that to depreciation on all Joe's tools he uses and to Susan's vacuum cleaner and carpet shampooer she uses for cleaning. Then the total becomes quite high. In this scenario, about $25,000.

Yes you will need to keep some form of accounting spreadsheet, or use a type of accounting software to keep up with this but you will see when you read further how useful this can be.

The new figures that IRD includes their partnership loss of $12,000-$25,000 = -$13,000. If we split that between the two partners then that is -$6,500 each.

Joe $100,000 - $6,500 =$93,500 income, the tax he should have paid on that amount was

$21,775 PAYE and he has paid $23,920, so he will get a refund of $2,145.

Susan $100,000 - $6,500 =$93,500 income, the tax she should have paid on that amount was

$21,775 PAYE and he has paid $23,920, so she will get a refund of $2,145.

It is really important to understand this, this is not about hiding your little cash business, but actually declaring everything because you WILL find that it is running at a loss, and you will get tax back on it at this stage and possibly for a long time, depending how you your business grows.

It is worth going through the exercise to do this. Also, you do not need an accountant at this stage, but if you do have one, make sure they are aware of all the assets they need to depreciate, not just the ones you have purchased since you have been in business, but the ones you have in your possession that are now used solely for the business.

I hope this helps you, Kiwis are the kings of side hustles, but we have no idea how to really get the most out of our business when we are starting out. Crunch the numbers and see if it would work for you. It is worth the effort. Feel free to comment, like, share or follow this blog, I will try to help in every way I can. Have a fabulous day.

Comments

Post a Comment