How often should I pay my bills? Monthly? Weekly? Fortnightly? Annually? Does it even matter at all?

Often we quietly sit and continue to pay our bills as we always have, the way they were initially set up by the person (not us) that set them up. It makes no difference really does it?

Believe it or not, it makes a massive difference to your bottom line. We are wasting heaps of money each day by turning a blind eye to this.

Most bills we should just pay on their due date, for the total amount due. Especially those that change from month to month, power, water rates, internet, phone etc. Just pay them when they are due to be paid, often you get a discount for payment on time. Great! Keep doing that.

When it comes to insurances, they almost always offer a substantial discount for paying annually. If you possibly can this is the way to go. You will be the only one who knows if you can afford to do this. If you can that's great, you can also alternate between paying regular payments through the year and sometimes paying annually. It is perfectly ok to swing from one to the other depending on what is going on in your life at the time.

Then there are some other payments that we can choose to pay monthly, weekly, fortnightly. Usually these are payments for things like mortgages, personal loans and ongoing costs like these.

Let's look a bit deeper into these ones for a moment.

If we pay monthly there can be a number of ways we are not getting the best for our money.

- most people do not get paid monthly so it doesn't fit well into their budget cycle.

- if you pay monthly payments you get to pay 12 payments a year.

- months are different lengths, they are sometimes two fortnightly payments, sometimes three, so it is difficult to compare monthly payments with how many wages payments you get.

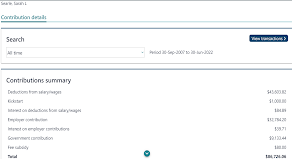

- eg. mortgage payments for a $350,000 mortgage are $2201/mth, mortgage is 30 years

- most people get paid fortnightly so it fits well with their fortnightly budget

- if you pay fortnightly you get 26 payments a year, (if you compare to monthly you only get 24 half months a year) so two more fortnightly payments a year. This can make a massive difference in the term of a mortgage or loan.

- fortnights are always the same amount of days no matter when they fall in the calendar year.

- eg. mortgage payments for a $350,000 mortgage are $1101/ftnt (half the monthly payment above), mortgage is now only 24 years, saving 6 years in payments or a total saving of $171,756!!!!!!!!

- some people get paid weekly and so they think this fits well with their weekly budget

- if you pay weekly you make 52 payments a year, all of which are half as much as a fortnightly payment. So no gain from paying extra payments as there are none.

- weeks are always the same amount of days no matter when they fall in the calendar year.

- eg. mortgage payments for a $350,000 mortgage are $550/wk (half the fortnightly payment above), mortgage is now still 24 years, not saving any more than being on a fortnightly payment. Money is not left in your account for the extra week. The extra week creates a great buffer when times are tough. There are other reasons for this that I will outline in a further blog.

This is great information for mortgage debt saving's, Thank you. Its good to know that being paid fortnightly doesn't make a difference to making payments on the mortgage, I have always done weekly as i thought the longer lengths between repayments the more interest can accumulate over the time, but if it is the same calendar days in fortnights it doesn't make a difference. I get paid weekly and have the mortgage repayments weekly as that is what works best for my budgeting. - Shawn

ReplyDeleteThanks so much for your feedback Shawn, it is great you are considering all of these comments and making your own decisions about your finances. It is much easier to make these when you are equipped with both sides of the story. Good decision to carry on with what works for you and your budgeting. Well done.

ReplyDelete